When many of us think about capital gains we think of investors, but you as a homeowner could also be subject to capital gains tax.

It comes into play when you sell your home (or other assets) at a profit.

There are two types of capital gains tax – short term and long term.

Short term capital gains apply if you’ve owned the asset for one year or less. This tax is based on your tax rate for that year. The profit will be added to your ordinary income and you’ll pay tax on the gain no matter how much you earned.

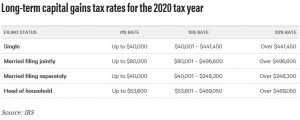

Long term capital gains rates are based on your income, but you’re your tax rate. They apply if you’ve owned the asset for more than one year. According to Bankrate.com, The long-term capital gains rates for real estate are as follows:

Texas does not impose additional capital gains tax, although many other states do.

The primary residence tax exemption may erase your capital gains liability.

If you meet certain requirements, you and your spouse are each entitled to deduct $250,000 from the profit on your sale. Thus, if you paid $200,000 for your home many years ago and now sell it for $700,000 you will owe no tax.

The requirements are:

- You must have owned the home for at least two years.

- It must be your primary residence – not your summer cabin or winter retreat.

- You must have lived in it for at least two of the past five years.

- You must not have taken this exclusion on another house within the past two years.

There are exceptions if, for instance, your job forces you to move in less than 2 years. See IRS Publication 523 and consult your tax advisor.

Remember that capital gains tax is imposed only on your profit, so keep track of home improvements.

If you’ve replaced your roof, built a deck, replaced windows and doors, or finished the basement, all of those costs add to the cost – or “basis” – of your home.

Make sure to keep receipts and records of all such improvements – just in case your home appreciates beyond the primary residence exemption. Do keep in mind that ordinary repairs and maintenance don’t count.

You may owe very little if you sell an inherited house.

The good news about paying taxes on the sale of an inherited home is that the basis is “stepped up.” The original price of the home becomes irrelevant, and the value is set as of the day the owner passed away.

This is extremely beneficial to heirs whose parents paid $25,000 for a home back in the 60’s, and it is now worth half a million or more.

Is there a way for Texas real estate investors to avoid capital gains tax?

Yes, but it does require following specific steps. The solution is to swap like-kind properties through the use of a 1031 exchange. Such an exchange has strict rules regarding timelines and guidelines. Before attempting this, consult with an account and a real estate attorney. Then work with a real estate professional who is up-to-date on the rules regarding a 1031 exchange.

Here at Homewood Mortgage, the Mike Clover Group, we’re always happy to help our clients look at ways to benefit financially. If you have questions or want to know your options, just give us a call.

Call us today at 800-223-7409

54,818 Responses to Could Capital Gains Tax Erode your Texas Home Equity?