When you’re planning to use a personal loan to buy a car, check the offers provided by car loan dealers, When you buy a house and will need a mortgage, and you’ll have choices. While a few do qualify for VA or Farm Home loans, most must choose between Conventional and FHA.

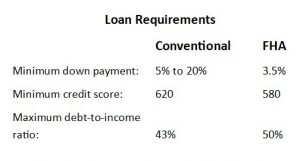

Right now, about 40% of all home loans are FHA – which means they’re insured by the Federal Housing Administration. Each type has advantages and drawbacks, beginning with the loan requirements. Here, in general, are the differences between the two. (Some lenders may deviate slightly from these generalizations.)

Most Conventional lenders are looking for borrowers with steady income, solid assets, and well-seasoned credit scores. They want to see a debt-to-income ratio of 43% or less – which means that all of your debt, including car loans, student loans, credit card minimum payments, and your new mortgage payment will be 43% or less of your gross income. However we can go up to 50% debt to income. 43% is a lender overlay that we don’t have.

For example: If you earn $4,000 per month, your total debt must be no more than $1,720.

Most will tell you that Conventional loans require a 20% down payment, but that’s inaccurate. You can get a Conventional loan with as little as 5% down. However, to do so you will be required to pay for private mortgage insurance. This insurance, which ranges from 0.3% to 1.15% of your loan amount, can be paid entirely as an up-front fee or as an up-front fee combined with a monthly fee. Its purpose is to protect your lender should you default on the loan.

When your down payment is 20% or more of the sales price, you won’t be required to buy Private Mortgage Insurance.

FHA lenders are willing to take on more risk, because their loans are insured by the Federal Housing Administration, but again, you need to fin the right lender for you, there are plenty of options including national banks, a Local Credit Union and local banks.

These are good loans for buyers who have marginal credit and less cash to use as a down payment. While regulations say the borrower must provide 3.5% – those funds MAY be in the form of a gift from an approved source.

Approved sources include:

- A family member or close friend with a defined and documented interest in the borrower.

- The borrower’s employer or labor union

- A charitable organization

- A governmental agency or public entity with a program to assist low to moderate income families and/or first time homebuyers.

The funds may NOT come from anyone with an interest in the purchase and sale – such as the seller, the real estate agent, or the home builder.

The requirement for a 580 credit score is also flexible. Applicants with scores as low as 500 may be granted a loan if they make a down payment of at least 10%.

As already noted, FHA loans allow a debt to income ratio of 50%, so if your income is $4,000, your total debt can be as much as $2,000.

The drawbacks of an FHA loan…

First, these loans are generally capped at $417,000. (In some high-cost areas, the cap is $625,000.)

In addition, borrowers pay a mortgage insurance premium for the life of the loan. At present borrowers pay an up-front premium of about 1.75% and annual mortgage insurance of about 0.85% of the loan amount. The up-front fee is rolled into the loan, so if you’re borrowing $100,000 your loan amount will be $101,750. The annual fee is becomes part of the monthly mortgage payment.

If you’re not sure which loan is right for you, call us at Homewood Mortgage, the Mike Clover Group. We’ll be happy to discuss your situation and show you the differences in real numbers. We’ll also be happy to get you pre-approved for a home loan, so you can shop with confidence.

Call today: 800-223-7409

Pingback: NINJA เกมยิงปลา ตามล่า ปลาป่วย ตายง่าย เล่นที่ 2LOTVIP

Pingback: บาคาร่า Evolution gaming

Pingback: ราคาบอลออนไลน์ มีความหมายอย่างไร

Pingback: เครื่องกรองน้ำโคเวย์

Pingback: แทงหวย

Pingback: pomegranate shroom tea on sale

Pingback: order Blackberry Dream

Pingback: animal porn

Pingback: animal porn